How does bail bonds work in Hawaii?

Hawaii law sets the bond premium for bail bond agents at 10 percent. For example, if the bail is set at $50,000, the defendant pays $5,000. In some cases, bail bond agents will set up a payment plan to help defendants post bail. A cash bail will cost the entire bail amount and does not involve a bail bond agent.

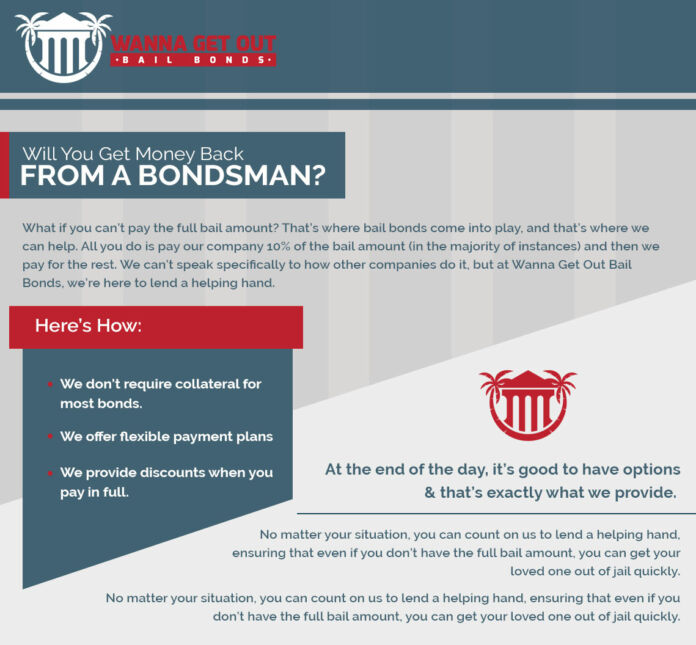

Does bail amount get refunded?

Answers (4) Cash bail, if you paid bail to the court, u paid the full bail amount , you will have money returned after defendant full filled all court appearance, if defendant arrested again out on bail, no refund. Here you have settled out of court , but you should inform court while filing MEMO. otherwise no refund.

Can you bail yourself out of jail in Hawaii?

For example, they keep that ten percent, so for the $10,000 bail, you have to pay $1,000 for a bondsman to post bail for you. If you pay that bail yourself, then at the conclusion of your case, you will receive it all back as long as you will show up for your court date. It is possible to get the bail lowered.

Can you pay bail with credit card Hawaii?

No checks or credit cards will be accepted, and no change will be given.

Can you bail yourself out of jail?

Can You Bail Yourself Out of Jail? Yes and no. If you are financially able to pay for the entire bail at the time of arrest, then you can bail yourself and be the only cosigner. The caveat, however, is that a bail is a cash bail, meaning that you must have the full amount on-hand to be released.

How do I pay my court fees in Hawaii?

Payment of federal court fees only (civil filing fees, certified copies, attorney admission fees, etc.), may now be paid online with a debit card, ACH (electronic payment from a bank account), or PayPal. The minimum online payment is $5.01. Do not pay any State of Hawaii court fees.

What happens if you don't pay a ticket in Hawaii?

Don't Pay the Traffic Ticket You're agreeing you violated Hawaii's traffic laws, and the ticket will go on your driving record. Depending on your current driving record, you could face other consequences, like a suspended license. Instead of paying the fine right away, talk with a lawyer for traffic tickets.

What is a moving violation in Hawaii?

A moving violation is a violation of a statute, ordinance or rule relating to traffic movement and control arising from the operation of a motor vehicle (including a commercial motor vehicle). Pursuant to Hawai`i Revised Statutes § 287-3 (Supp.

What is a fee conveyance Hawaii?

Recording Fees A conveyance tax fee is due upon recording. This is $0.10 per $100 of consideration. Documents should be accompanied by form P-64A, which is a Conveyance Tax Certificate.

What taxes do you pay when you sell a house in Hawaii?

The amount collected under the HARPTA law is 7.25% of the sales price. What is the actual Hawaii capital gains tax? The Hawaii capital gains tax on real estate is 7.25%.

What is a quitclaim deed Hawaii?

A Hawaii quitclaim deed is a deed that transfers property with no guarantee—or warranty of title. The new owner receives the entire interest the current owner can lawfully transfer. The current owner does not promise a good, clear title or that the deed will transfer actual ownership of the property.

Who pays the highest conveyance tax in Hawaii?

WHO IS RESPONSIBLE FOR PAYING THE TAX? The person responsible for the tax is generally the transferor, grantor, lessor, sublessor, conveyor, or other person conveying the real property interest (HRS §247-3).

Who pays the transfer tax in Hawaii?

In Hawaii, however, the transfer tax is taken out of the profit made from the house's sale, meaning the seller is the one responsible for paying any transfer taxes at closing.

What is the purpose of conveyance tax in Hawaii?

The conveyance tax is imposed on all transfers of ownership or interest in real property through deeds, leases, subleases, assignments of lease, agreements of sale, assignments of agreements of sale, instruments, writ- ings, or other documents, unless the transfer is specifically exempted.

How is Hawaii conveyance tax calculated?

How Is the Conveyance Tax Determined? One dollar and twenty-five cents ($1.25) per $100 of the actual and full consideration for properties with a value of $10,000,000 or greater. The conveyance tax imposed for each transaction shall be not less than one dollar ($1.00).

How much is Harpta?

7.25%

How do I record a deed in Hawaii?

A person who wishes to record a deed must submit the deed to the Bureau of Conveyances with one or more of the following forms: Conveyance tax certificate (Form P64-A). A completed and signed Form P64-A must be filed with a deed that requires payment of conveyance tax.

What is Harpta withholding tax?

HARPTA is a Hawaii state tax law which requires withholding 7.25% from the proceeds of certain real estate transactions if the seller is not a resident of Hawaii. It is similar to the federal FIRPTA withholding.

How can I avoid paying HARPTA?

File a Form N-288B (with Form N-103 included if applicable) in a timely manner prior to closing to avoid HARPTA withholding altogether if you qualify. Or, maybe you qualify for an N-289 exemption? Alternatively, you may need to file a Form N-288C to get your money back… if you don't qualify for an exemption.

What is Hawaii Form 289?

Use Form N-289 to inform the transferee/buyer that the withholding of tax is not required upon the disposition of Hawaii real property if (1) the transferor/seller is a resident person, (2) by reason of a nonrecognition provision of the Internal Revenue Code as operative under chapter 235, HRS, or the provisions of any

What is a 1031 exchange Hawaii?

A 1031 exchange allows an owner of an investment property to build wealth by exchanging that property for another investment property (or properties) and deferring the capital gains tax on the relinquished property.

What is the capital gains tax for the state of Hawaii?

7.25%

Does Hawaii tax depreciation recapture?

Besides capital gains tax, the depreciation recapture tax gets added to the tax bill. That is the tax on all the depreciation you deducted on your tax returns. The depreciation recapture is taxed at your ordinary income tax rate but is capped at a top 25% rate.

Can you do a 1031 exchange in Hawaii?

A 1031 exchange allows you to exchange Hawaii real estate property for a like-kind, so that no gain is realized and no tax is paid on the sale.